Microsoft beats expectations with nearly $25B in quarterly profits, as AI revenue boosts cloud growth

Microsoft beat Wall Street’s expectations across its key financial metrics for its first quarter of fiscal 2025, as artificial intelligence contributed 12 percentage points, a new high, to a 33% increase in the company’s Azure cloud revenue.

The company overall posted revenue of $65.6 billion, up 16%, vs. analyst expectations of $64.5 billion; profits of $24.7 billion, up 11%; and earnings per share of $3.30, compared to the Wall Street consensus of $3.08 per share.

“We are expanding our opportunity and winning new customers as we help them apply our AI platforms and tools to drive new growth and operating leverage,” Microsoft CEO Satya Nadella said in the company’s earnings release.

Investors are watching the company’s results closely as a barometer of the broader demand for AI services from businesses, and a sign of the potential for AI to lift the tech industry over the long term.

Microsoft did not disclose specific revenue growth figures for its Microsoft 365 Copilot productivity tools for businesses as part of its earnings. However, Nadella said on the call that nearly 70% of the Fortune 500 now use Microsoft 365 Copilot, noting that customers are adopting it at a faster rate than any other new Microsoft 365 suite.

A large portion of the company’s AI cloud growth is coming from the Azure OpenAI service, leveraging technology provided by the company’s key AI partner, ChatGPT developer OpenAI. Amid questions about Microsoft’s relationship with OpenAI, and its dependence on the startup, Nadella said this on Microsoft’s earnings call.

“Our partnership with OpenAI also continues to deliver results. We have an economic interest in a company that has grown significantly in value, and we have built differentiated IP and driven revenue momentum. More broadly, with Azure AI, we are building an end-to-end app platform to help customers build their own Copilots and agents. Azure OpenAI usage more than doubled over the past six months.”

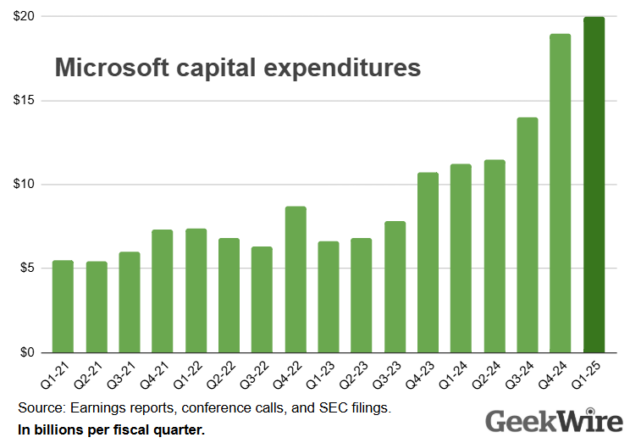

Microsoft’s capital expenditures reached a record $20 billion for the quarter, as the company continued to build out its infrastructure for training and running massive artificial intelligence models.

The company saw double-digit growth across its three primary divisions:

- Intelligent Cloud posted the biggest revenue increase, up 20% to $24.1 billion, driven by server products and cloud service revenue. That included Azure growth, fueled in part by demand for AI services.

- More Personal Computing, which includes the Windows business, posted $13.2 billion in revenue, up 17%. That included an 18% increase in Microsoft’s search and news advertising revenue, and a 61% increase in Xbox content and services revenue, driven largely by new revenue from the company’s Activision-Blizzard acquisition.

- Productivity and Business Processes, which includes Office products under the Microsoft 365 umbrella, remained the largest division, with $28.4 billion in revenue, but saw the smallest percentage growth, 12%.

LinkedIn revenue rose nearly 10% to $4.3 billion. Microsoft, which acquired the business social network for $26 billion in 2016, said it experienced growth across its business, in Talent Solutions, Marketing Solutions, Premium Subscriptions, and Sales Solutions. LinkedIn sessions grew 11% in the quarter.

Microsoft Dynamics products and services, where the company goes head-to-head with Salesforce and other enterprise application companies, grew 14% to $1.85 billion in the quarter.