Gaming industry trends to watch in 2025: Distribution channels, console wars, and more

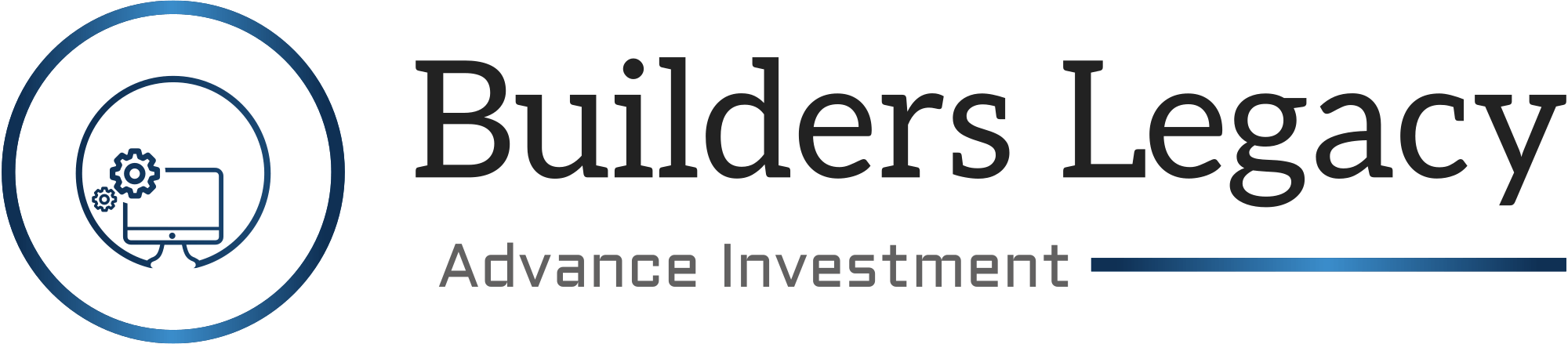

As 2024 draws to a close, one advisory firm predicts the video game industry will see a major rebound in 2025 following two years of declines.

San Diego-based DFC Intelligence released its 2024 Video Game Market Report and Forecast, which lays out a case that 2025 will bring a reversal of fortune for the industry as a whole. The report consciously focuses on the PC and console markets, while mostly omitting the much larger mobile sector.

The gaming business has recently been plagued by layoffs, studio closures, and canceled projects, with well over 24,000 dismissals worldwide in the last two years. Just in Washington state, we’ve seen cuts at Microsoft, Bungie, Epic Games, Hidden Path Entertainment, and Wizards of the Coast, while local studios like Firewalk, Galvanic Games, and Ridgeline Games have been shuttered.

This can be tied into an overall decline in gaming revenue that started in early 2023, despite a packed release calendar. DFC notes that this was only a 4% drop, but it was the first setback of its kind for “overall software revenue” since 2009.

The report blames multiple factors for the 2023-2024 slump, including an end to the artificial revenue inflation from the COVID lockdown years; multiple product delays as the industry adjusted to remote work; the pandemic’s attendant disruptions to the console market, as both Sony and Microsoft launched new systems in November 2020; and renewed competition from other hobbies, such as travel and outdoor entertainment.

In 2025, DFC forecasts multiple factors that will reverse those trends, and argues that the video game market will “start soaring.” These include:

- DFC notes that the game industry has stayed on an overall upward curve since roughly 1985. There have been downturns before, such as a slump in 2009 following the Great Recession, but they tend to be short and small. That suggests that the chaos of the last two years was a painful but temporary setback.

- Nintendo reportedly plans to launch a new console in 2025 as a successor to the Switch. Very little is known for sure about the “Switch 2” at time of writing, but multiple third-party product leaks suggest that it’s coming sooner than we might think. As the Switch is Nintendo’s most popular console in decades, its follow-up is expected to be a top seller on release.

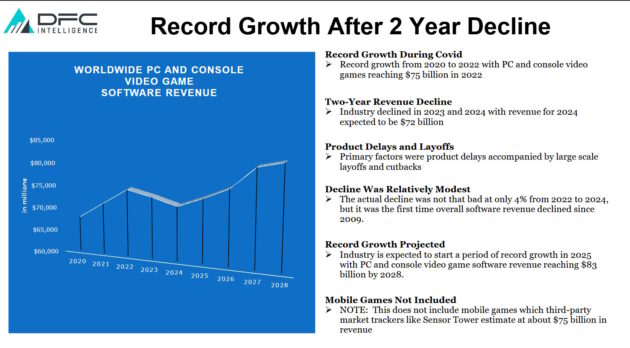

- Rockstar Games’ hotly anticipated Grand Theft Auto VI has no firm release date, but could come out in Q4 2025. Its predecessor, 2013’s Grand Theft Auto V, is one of the best-selling games of all time and has stayed in the yearly top 20 for over a decade, primarily on the strength of its popular GTA Online multiplayer mode. It’s expected that GTA6 will be a comparatively seismic event, and may drive fence-sitters to pick up new consoles with which to play it.

- DFC argues that “inflation has created a more cost-conscious consumer.” Video games provide solid value for the money, particularly in an environment where a family outing to an amusement park, or two trips to a movie theater, can cost as much as a Switch. Much as in the years immediately following the Great Recession, video games simply make good financial sense for customers’ limited entertainment budgets.

- The various disruptive effects of post-COVID workflow and supply chains have settled down by this point. Some larger companies have experienced friction with remote work like any other industry, but in practice game development has become comfortable with widely distributed teams.

Console wars, 2025 edition

As a result, DFC anticipates the worldwide audience for video games will hit 4 billion by 2027, or nearly half the world population. However, this sets up an attendant challenge, as DFC finds that the top 10% of the gaming audience in 2024 accounts for 65% of overall industry revenue. The bottom 90% of the audience only averages roughly $20 in revenue per user.

This is similar to the issues that mobile and PC studios have reported with the free-to-play publishing model. In industry parlance, these are “whales” and “minnows”; minnows are determined to spend no real money on a game if it’s at all possible, while whales will make regular purchases in-app.

Some of this is anticipated to be counteracted by the aging of the average video game consumer. Generation X is the first demographic to have grown up playing video games on a regular basis, and as it gets older, it generally has more money to spend on expensive hobbies. That includes “increased sophistication around hardware purchases,” such as tricked-out gaming PCs.

That and other factors drive an expectation that the console war may heat up in 2025, as Nintendo’s new system goes head to head with the declining PlayStation 5 and Xbox Series X|S.

By 2028, when both Sony and Microsoft are expected to release new systems, that suggests that generation of consoles will repeat history: Nintendo will be deeply entrenched in the marketplace, which gives the new PlayStation and Xbox a steep hill to climb. The successes of both the Switch and Valve’s Steam Deck suggest that portability may be a new desired factor for gaming consoles going forward, although both Sony and Microsoft do currently have products intended to address that.

Technically, Nintendo has “won” the current console generation before it started, although it had a 3-year head start. The Switch came out in 2017 and has sold just over 146 million units, as per Nintendo’s own numbers. Sony’s most recent internal numbers estimate the PlayStation 5 has sold not even half of that, while Microsoft hasn’t disclosed its hardware sales for years but is generally understood to be in a distant third place. Nintendo also famously uses a different sales model for its hardware than its competitors, where it makes a small per-unit profit on every Switch sold.

DFC Intelligence argues that the next generation of consoles is likely to have a distinct loser, as the market sector cannot sustain three major players. It’s a bold statement, but isn’t entirely borne out by the market; Microsoft has sold considerably fewer consoles than Sony or Nintendo, but still makes a profit off its video game division and is moving into a position as a cross-platform game publisher.

The rising importance of distribution

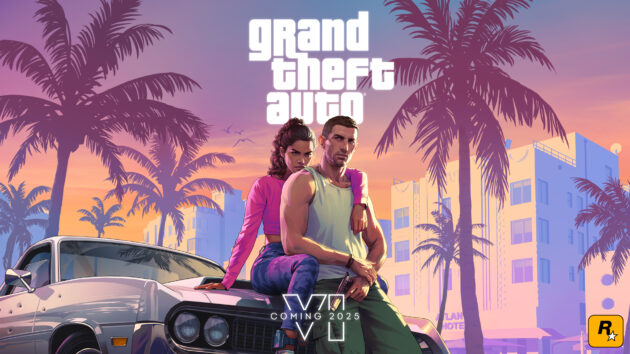

The biggest point in DFC Intelligence’s report may be its focus on distribution channels.

At this point, DFC argues, one of the major drivers behind success in the games industry is a single company’s ability to get their games into players’ hands, whether that means a physical copy, a digital download, or an app on their mobile device.

Major current distributors include console manufacturers (Microsoft, Nintendo, Sony, increasingly Valve), digital storefronts (Valve again, Epic, Google, Apple), and major retail chains (GameStop, Walmart). Each of these tend to represent their own sort of “walled garden,” where customers are enticed to shop there by convenience, exclusive benefits, or ubiquity; for example, it’s nearly impossible in 2024 to be a dedicated PC gamer without an account on Steam.

Back in 2018, it appeared that many of the major companies were warming up to establish their own exclusive distribution networks, such as Ubisoft’s uPlay, Electronic Arts’ EA Play, and Activision Blizzard’s Battle.net. While many of those services still exist in 2024, it’s rare for them to have any platform exclusives; nobody’s going to buy Assassin’s Creed on uPlay when all their friends are still on Steam/PlayStation/Xbox.

With the barriers between consoles and platforms getting increasingly softer, due to initiatives like Microsoft’s cross-platform publishing and Sony bringing many of its games to PC, DFC argues that the next major battle in the video game space will instead be over methods of distribution. It’s a potential trend to watch as the market continues to spin off into unanticipated directions.

Several other emergent factors were not factored into the report, such as the potential for rising import costs with the incoming presidential administration. However, DFC’s analysis does mesh with that of PitchBook, which recently noted in its Q3 report that investment in the gaming sector has modestly increased after virtually cratering late last year. It does seem like the games industry, after 24 months of bad news, may be back on the rise.