Amazon bets big on sports streaming in bid to boost Prime memberships, advertising revenue

When Charlie Neiman arrived at Amazon in 2016, the company had never streamed a live event, let alone live sports.

Fast forward eight years later, and Amazon has emerged as a leader in the burgeoning sports streaming world.

“It is crazy how far we’ve come in a relatively short period of time,” said Neiman, head of sports partnerships for Amazon Prime Video. “I don’t think there’s really a precedent for what we’ve accomplished as an organization.”

Amazon has invested billions of dollars to buy expensive sports media rights and build out extensive cloud computing infrastructure required to stream games for Prime members around the globe.

The company is betting that the strategy will pay off in the form of additional Prime membership sign-ups ($139/year) and new revenue to fuel its growing advertising business.

Live sports remains one of the most-watched telecasts.

“Sports are very attractive for our customers and you can expect us to do more,” Amazon CEO Andy Jassy told CNBC earlier this year.

As more people cut the cord, sports leagues are increasingly engaging with tech companies as their existing deals with traditional cable providers expire. Google has a substantial deal with the NFL, Apple partners with Major League Soccer, and even Netflix is getting in on the action.

“Over time, I think live sports is going to be viewed just as often and as frequently on streaming as it is on linear TV,” Mike Hopkins, head of Prime Video, said at a Bloomberg event this week.

The company’s live sports investments are part of a broader move to build the “next generation of an entertainment service” that goes beyond on-demand movies and TV shows, Hopkins said.

Amazon is reportedly expanding into live news, tapping longtime anchor Brian Williams to lead election night coverage next month, according to CNN.

Tonight at Lumen Field in Seattle, just a few miles from Amazon’s headquarters, the tech giant will stream this week’s NFL Thursday Night Football game to millions of Prime members worldwide as the Seahawks host the San Francisco 49ers in a NFC rivalry matchup.

The exclusive NFL deal, worth a reported $10 billion over 10 years, is the crown jewel of Amazon’s live sports catalogue. Viewership through the first four games this seasons was up 20% year-over-year, at 14.17 million viewers.

Later this week, Amazon will stream its first regular season NHL game in a new deal this season with the Seattle Kraken, part of a larger potential move into local sports.

The company is also set to stream NBA games starting with the 2025-26 season (and reportedly pay the league $1.8 billion annually). NASCAR races will come to Prime next year. It has additional deals with the WNBA, UEFA and Champion’s League (men’s soccer), NWSL (women’s soccer), PBC (boxing), and others.

Amazon has differentiated itself by building out technical capabilities, taking advantage of Amazon Web Services, its $100 billion cloud business.

The company got off to a rocky start with its initial Thursday Night Football streams several years ago but the latency has been vastly reduced with new proprietary technology, Neiman said.

It can also offer unique advertising opportunities through “audience-based creative,” which lets brands tailor ads to specific customer segments, thanks to the company’s vast data trove on more than 200 million Prime members.

“You’re no longer beholden to a one-to-many message,” Neiman said.

Last year Amazon aired the first Black Friday game in NFL history, incorporating various in-game shopping features.

Amazon has helped bring 50 new advertisers to NFL programming, Neiman said.

There’s also the opportunity for leagues to experiment with new broadcast experiences.

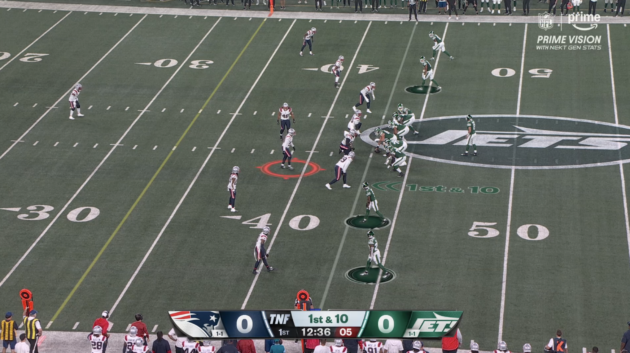

In addition to its main broadcast for Thursday Night Football, Amazon offers “Prime Vision” as an alternative viewing option that incorporates additional circles, colors, orbs, and other digital shadings, powered by machine learning and RFID chips embedded on each player.

Features include “Defensive Alerts,” which is able to spot potential defensive players that will rush the quarterback, or “Prime Targets,” which identifies open receivers during a play.

Some aspects of the Prime Vision stream periodically end up appearing in the primary broadcast.

GeekWire reviewed Prime Vision last month — the technology is impressive, but it may not be for every NFL fan.

And that’s part of the point, Neiman said.

“There is a segment of fans who want more, and they want to experiment with different pieces of going deeper,” Neiman said. “That could be advanced stats, that could be alternate streams, it could be AI integrations. We’re investing and inventing the experience to try to figure out how to best serve those fans.”

Streaming sports over the internet, versus a traditional cable broadcast, gives Amazon the flexibility to experiment.

“It’s the beauty and freedom of being a digital-first entity,” Neiman said.

You can expect more testing as Amazon pushes the envelope on the consumer viewing experience — both during games and commercial breaks.

“Sports fans are incredibly passionate about their teams and leagues and the games,” Neiman said. “It’s an area where there’s endless opportunity for innovation.”